san francisco payroll tax rate 2021

Tax rate for nonresidents who work in San Francisco. San Francisco 2021 Payroll Tax - 2021 California State Payroll Taxes.

How To Calculate Payroll Taxes For Your Small Business The Blueprint

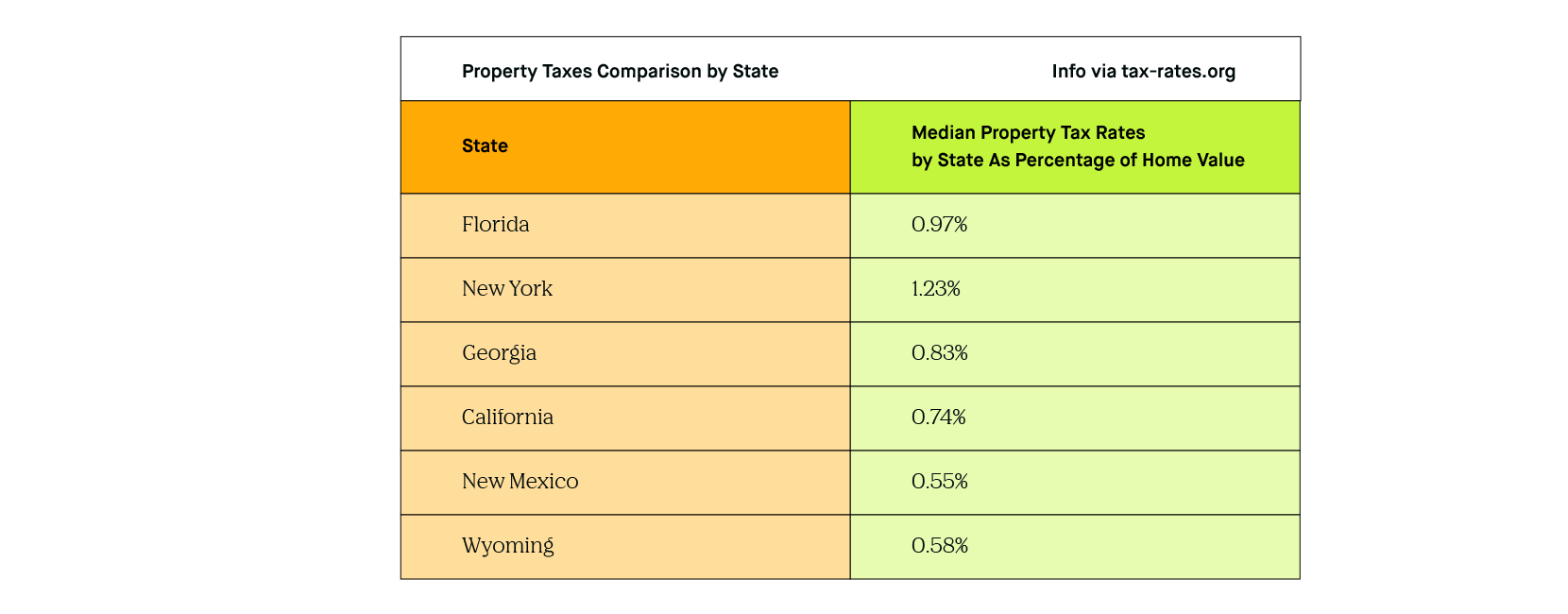

Nonresidents who work in San Francisco also pay a local income tax of 150 the same as the local income tax paid by residents.

. City and County of San Francisco. The tax rate for 2019 is 09 and youll need to withhold this tax from employees earning more than 200000 per year. Effective January 1 2022 businesses subject to the San Francisco Administrative Office Tax AOT must pay an additional annual Overpaid Executive Tax OET of 04 to 24 on their payroll expense in San Francisco when their highest paid managerial executive earns more than 100 times the median compensation paid to employees in San Francisco.

Proposition F repeals the payroll expense tax as of January 1 2021. Beginning in 2022 Proposition L called the Overpaid Executives Gross Receipts Tax adopts an additional gross receipts tax that applies to businesses whose highest paid managerial. The due date for filing the san francisco 2021 annual business tax sf abt return which includes reporting and payment of 1 the gross receipts tax grt or administrative office tax aot 2 the homelessness tax hgrt or the homelessness administrative office tax haot and 3 the commercial rents tax crt is february 28 2022.

Certain taxpayers engaged in administrative office business activities are not subject to the GRT or the payroll tax but instead pay a 14 tax on total payroll expense. San francisco payroll expense tax 2021 rates 5 Best Payroll Companies - Our Best Choice for Jan 2022 best payroll servicesbiz Payroll _CompanyOnline. This 6 federal tax on the first 7000 of each employees earnings is to cover unemployment.

San francisco payroll tax withholding. Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their business annually by the last day of February for the prior calendar year Jan. File Annual Business Tax Returns 2021.

Proposition F eliminates the payroll expense tax and replaces it by increasing the gross receipts tax rate across all industries effective Jan. Get Started With ADP. The current Payroll Expense Tax was originally set to phase out ratably between 2014and 2018 but was postponed by the City in 2018.

To avoid late penaltiesfees the returns must be submitted and paid o n or before February 28 2022. We offer Payroll forms software that can help you calculate different types of payroll taxes. This is the total of state county and city sales tax rates.

Ad Process Payroll Faster Easier With ADP Payroll. Discover ADP For Payroll Benefits Time Talent HR More. Repeal of payroll expense tax.

The average Payroll Tax Manager salary in San Francisco CA is 97441 as of September 27 2021 but the salary range typically falls between 87488 and 124919. File Annual Business Tax Returns 2021 Instructions. Interestingly San Franciscos gross receipts tax actually replaced a pre-2012 15 payroll tax on San Francisco employees.

The tax rate reaches its maximum level when the ratio reaches 600 to 1 with a maximum tax on payroll of 24 percent or a surcharge on. The County sales tax rate is 025. Effective in 2021 Proposition F 1 1 repeals the 038 percent Payroll Expense Tax 2 increases the Gross Receipts Tax rates across industries as well as increasing the annual registration fees for certain taxpayers 3 decreases the annual.

In most cases youll be credited back 54 of this amount for paying your state unemployment taxes on time resulting in a net tax of 06. Please refer to the table below for a list of 2021 Payroll Taxes employee portion and employer portion that are applicable to the city of San Francisco in the state of California. The 2020 Annual Business Tax filings are not impacted by this change.

Proposition F formally eliminates the payroll expense tax as of January 1 2021 commensurate with gross receipts tax rate increases of approximately 40 across most business classifications phased in over a four-year period. The San Francisco sales tax rate is 0. The due date for filing the san francisco 2021 annual business tax sf abt return which includes reporting and payment of 1 the gross receipts tax grt or administrative office tax aot 2 the homelessness tax hgrt or the homelessness administrative office tax haot and 3 the commercial rents tax crt is february 28 2022.

The minimum combined 2022 sales tax rate for San Francisco California is 863. Depending on the business activity some rates for lower brackets of receipts will be temporarily reduced including for retail trade food services the arts manufacturing accommodations and certain services. The tax rate reaches its maximum level when the ratio reaches 600 to 1 with a maximum tax on payroll of 24 or a surcharge on the gross receipts tax of up to 6.

The San Francisco Annual Business Tax Returns include the Gross Receipts Tax Administrative Office Tax Commercial Rents Tax and Homelessness Gross Receipts Tax. Payroll Expense Tax. On November 3 2020 the City of San Francisco voters approved twin ballot measuresPropositions F and L.

Proposition F fully repeals the Payroll Expense Tax and increases the Gross Receipts Tax rates across most industries while providing relief to certain industries and small businesses. Proposition F was approved by San Francisco voters on November 2 2020 and became effective January 1 2021. The tax rate is based on withholdings chosen on the employees W-4 form.

Beginning in 2021 Proposition F named the Business Tax Overhaul raises gross receipts tax rates for all businesses when it is fully implemented. The tax is calculated as a percentage of total payroll expense based on the tax. Businesses exempt from the Citys gross receipts tax due to being a small business enterprise are exempt from the pay ratio tax.

It also repeals the citys payroll expense tax. The California sales tax rate is currently 6. Residents of San Francisco pay a flat city income tax of 150 on earned income in addition to the California income tax and the Federal income tax.

Watch our instructional videos on filing your.

Working From Home Can Save On Gross Receipts Taxes Grt Topia

San Francisco Voters Approve Ballot Measures Overhauling City S Business Taxes And Imposing A New Overpaid Executive Gross Receipts Tax Deloitte Us

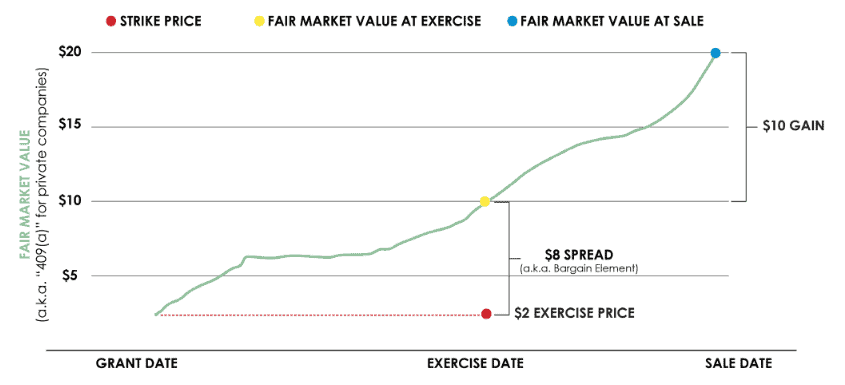

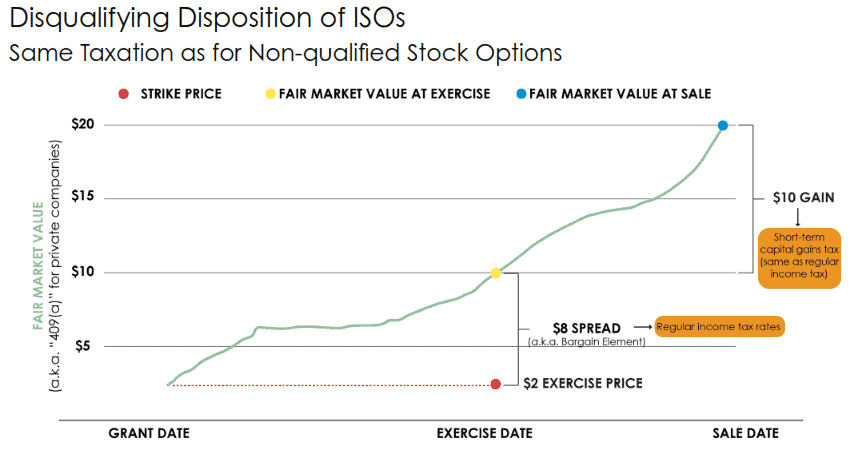

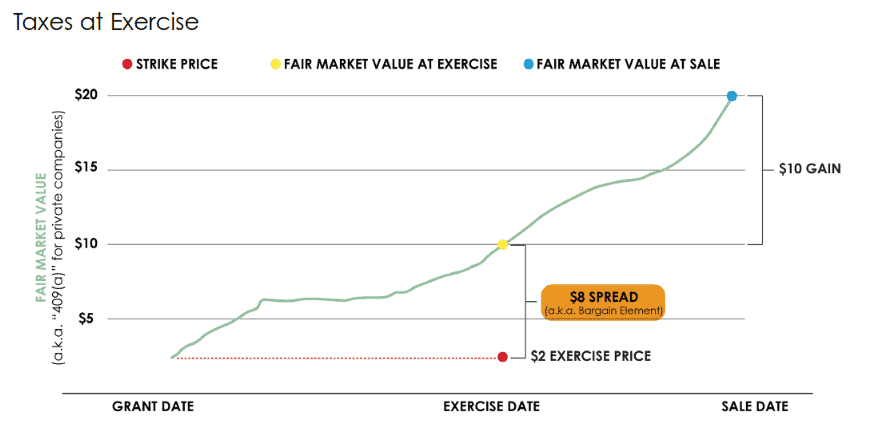

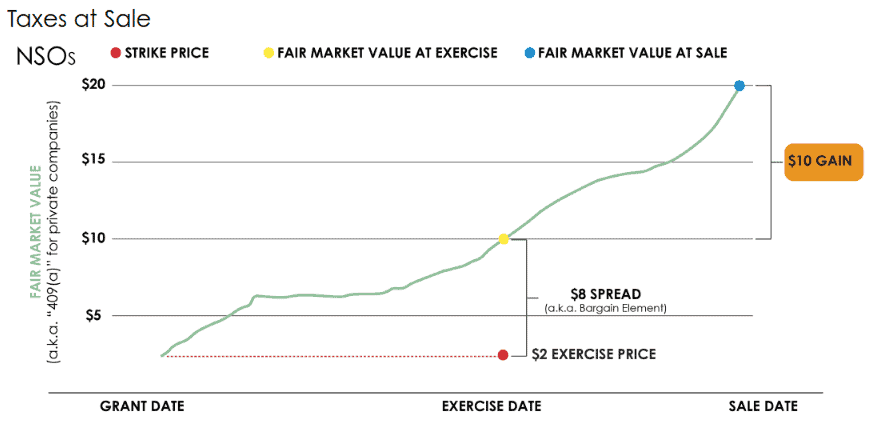

Stock Options 101 How The Taxes Work Part 2 Of 2

San Francisco Voters Approve Ballot Measures Overhauling City S Business Taxes And Imposing A New Overpaid Executive Gross Receipts Tax Deloitte Us

Employee Retention Credit Erc Available For All Of 2021 And Ppp Loan Recipients Can Claim Ercs Washington Business Journal

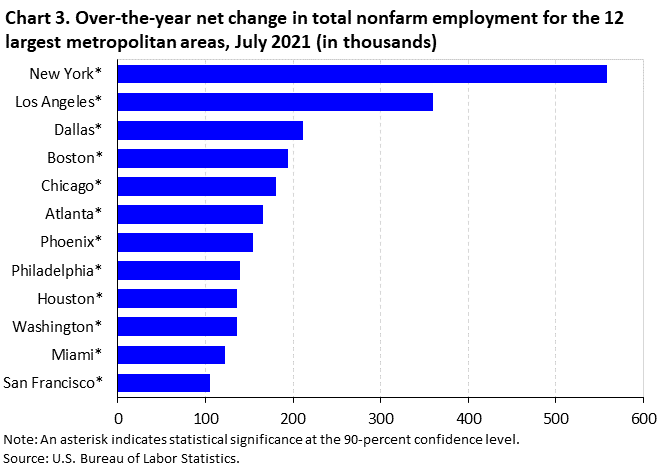

New York Area Employment July 2021 New York New Jersey Information Office U S Bureau Of Labor Statistics

Stock Options 101 How The Taxes Work Part 2 Of 2

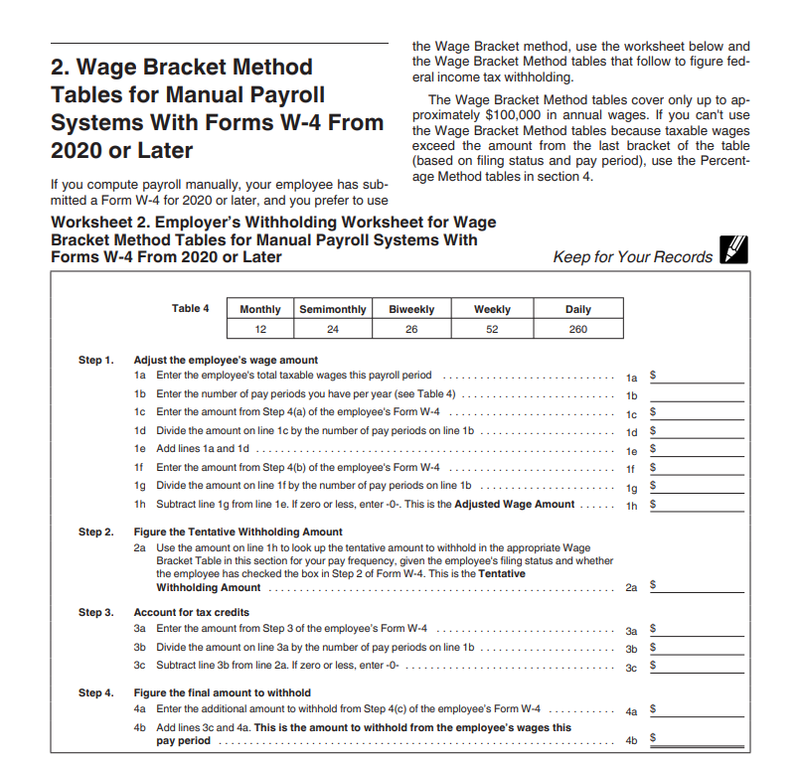

How To Calculate Payroll Taxes For Your Small Business The Blueprint

Stock Options 101 How The Taxes Work Part 2 Of 2

How To Calculate Payroll Taxes For Your Small Business The Blueprint

San Francisco Voters Approve Ballot Measures Overhauling City S Business Taxes And Imposing A New Overpaid Executive Gross Receipts Tax Deloitte Us

What Is A Payroll Tax 2021 Robinhood

Working From Home Can Save On Gross Receipts Taxes Grt Topia

San Francisco Voters Approve Ballot Measures Overhauling City S Business Taxes And Imposing A New Overpaid Executive Gross Receipts Tax Deloitte Us

Working From Home Can Save On Gross Receipts Taxes Grt Topia